maine excise tax rate

As of August 2014 mil rates are as follows. The tax rate on all other fuels is based on each gallon.

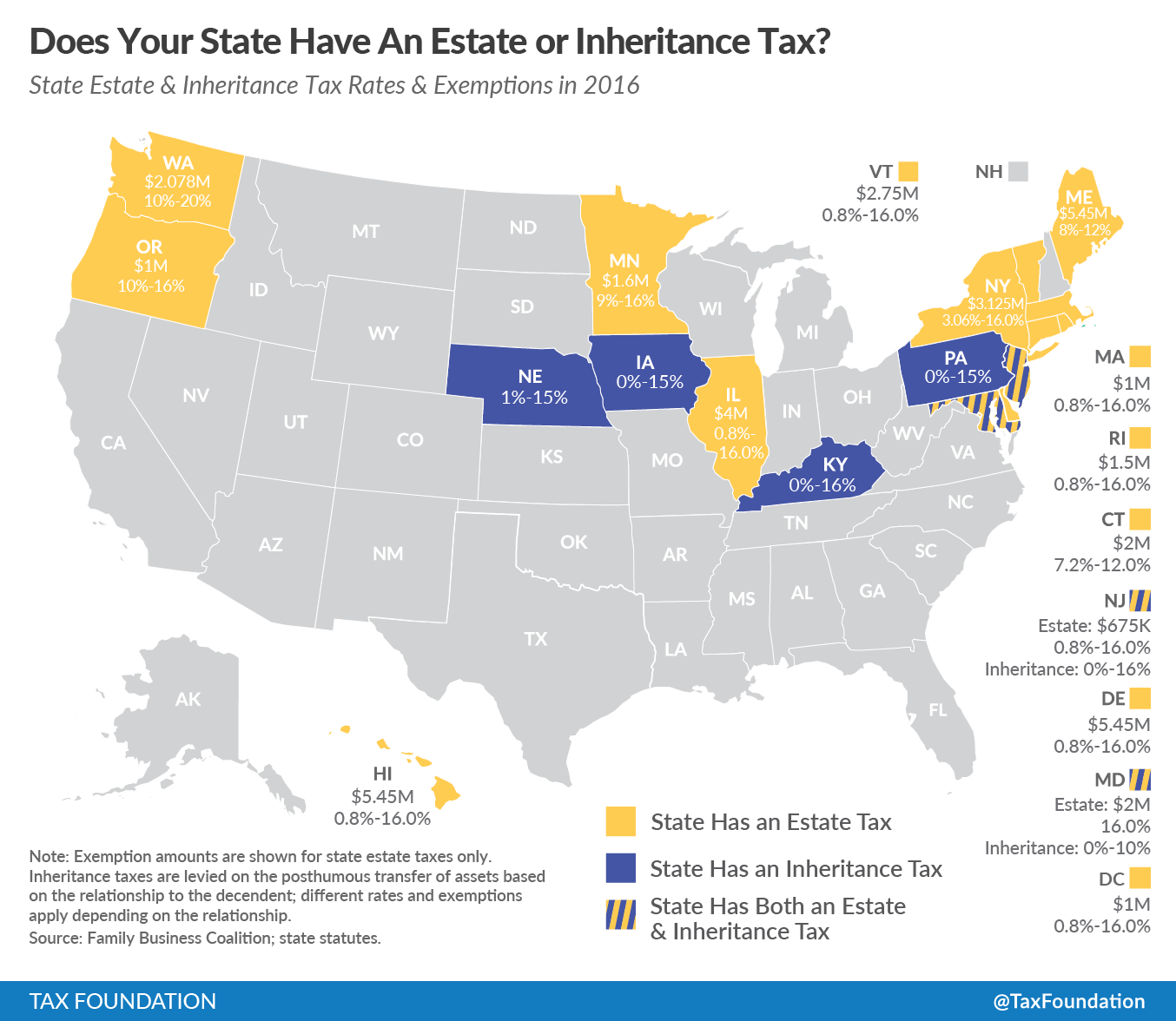

Maine Governor Lepage Proposes Good Tax Policy In New Budget Tax Foundation

For all other watercraft the tax payable shall be reduced.

. Maines Office of the Revisor of Statues explains that youll pay 5 per year in excise tax if you own a motor vehicle. Excise Tax is calculated by multiplying the MSRP by the mil rate as shown to the right. July 1 - June 30.

For any commercial vessel the tax payable shall be 50 of the value due under subsection 1. B 9 NEW B. Enter your vehicle cost.

- NO COMMA For new vehicles this will. Commercial Forestry Excise Tax. The excise tax you pay goes to the construction and.

These rates apply to the tax bills that were mailed in August 2022 and. 16 rows 1 CNG Hydrogen and Hydrogen CNG tax rate is applied to every 100 cubic feet. Maines Office of the Revisor of Statues explains that youll pay 5 per year in excise tax if you own a motor vehicle.

For questions about your tax bill please contact the Division of Collection and. This calculator is for the renewal registrations of passenger vehicles only. The rates drop back on January 1st each year.

Rates Prepared food containing Medical Marijuana is subject to tax at 8 Due Dates Returns are due no later than the 15th of the month. Tax Return Forms. 2721 - 2726.

6 TAXATION OF MOBILE HOMES AND CAMPER TRAILERS REFERENCE. 22500 X 0100 225. The excise tax you pay goes to the construction and.

13 rows Tax Rates The following is a list of individual tax rates applied to property located in the unorganized territory. How much will it cost to renew my. Tax Rate Per 1000 2000 mils.

MAINE REVENUE SERVICES PROPERTY TAX DIVISION PROPERTY TAX BULLETIN NO. Excise Tax is calculated by multiplying the MSRP by the mil rate as shown below. The excise tax due will be 61080 A registration fee of 3500 and an agent fee of 600 for new vehicles will also be charged for a total of 64180 due to register your new vehicle.

2 For reporting periods beginning on. Contact 207283-3303 with any questions regarding the excise tax calculator. Mil rate is the rate used to calculate excise tax.

1 day agoThe department issued a news release on Tuesday announcing the motor fuels and alternative fuels tax for 2023 will increase from the current 385 cents to 405 cents per gallon. This calculator will allow you to estimate the amount of excise tax you will pay on your vehicle. Interest Rates 1992 to Present.

The rates drop back on January 1st each year. The Commercial Forestry Excise Tax CFET is imposed on owners of more than 500 acres of commercial forest land. Welcome to the City of Bangor Maine - Excise Tax Calculator Notifications from the City of Bangor View a list of City Councilors and City Staff Bangor City Hall 73 Harlow Street Bangor.

Designed to provide the public with answers to some of the. YEAR 1 0240 mil rate YEAR 2 0175 mil rate YEAR 3 0135 mil rate YEAR 4 0100 mil rate.

Excise Tax Information Cumberlandme

I Team Maine Excise Tax Among The Highest In Us How Is That Money Spent Wgme

Maine Income Tax Calculator Smartasset

Maine Reaches Tax Fairness Milestone Itep

On A Single Plot In Rural Maine A Slew Of Rhode Island Car Registrations The Boston Globe

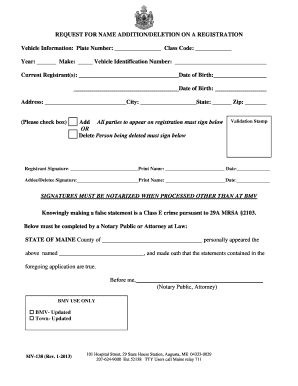

Maine Form Registration Fill Out And Sign Printable Pdf Template Signnow

Motor Vehicle Registration Scarborough Town Of

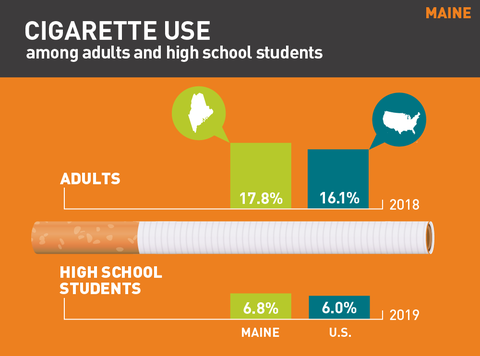

Maine Cigarette And Tobacco Taxes For 2022

Northeast Cigarette Tax Rates Map 2013 02 21

Maine Alcohol Sales Went Flat After Boom Early In The Pandemic Portland Press Herald

Augusta Councilors Approve Tax Break For 250 Unit Housing Development Centralmaine Com

Free Maine Motor Vehicle Bill Of Sale Form Pdf

Tax Friendly States And Cities Jan 28 2002

Sales Fuel Amp Special Tax Division Maine Gov

Car Tax By State Usa Manual Car Sales Tax Calculator

Tobacco Cigarette Tax By State 2022 Current Rates In Your Jurisdiction

It Is A Pickup Truck At Least In Maine It Is Hyundai Santa Cruz Forum